07 Dec Genesco Tops Wall Street Targets On Accelerating Comps

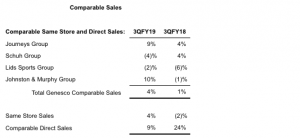

Genesco Inc. reported third-quarter earnings topped Wall Street’s consensus target as comps increased to their highest level in more than two years driven by the ongoing strength at Journeys and Johnston & Murphy. While still negative, sales trends at both Lids and Schuh continued to improve. The company narrowed its guidance for the year.

Third Quarter Fiscal 2019 Financial Summary

- Net sales were $713 million

- Comparable sales increased 4 percent

- GAAP EPS from continuing operations was $0.74

- Non-GAAP EPS from continuing operations was $0.95

GAAP earnings from continuing operations per diluted share of 74 cents a share for the three months ended November 3, 2018, compared to a loss per diluted share of $(8.55) in the third quarter last year. Adjusted for the Excluded Items in both periods, the company reported third quarter earnings from continuing operations per diluted share of 95 cents, compared to earnings per diluted share of $1.02 last year. Wall Street’s consensus estimate had been 86 cents.

Robert J. Dennis, Chairman, President and Chief Executive Officer, said:

“We achieved our highest quarterly comparable sales increase in more than two years driven by the ongoing strength of our U.S. footwear businesses. Journeys and Johnston & Murphy delivered strong performances both in-store and online, which fueled an acceleration in our combined consolidated store and digital comps on a sequential basis. While still negative, sales trends at both the Lids Sports Group and Schuh Group continued to improve following a very challenging start to the year. Even with the strong comp result, sales were down year-over-year due primarily to the calendar shift that moved an important back-to-school sales week out of the third quarter into the second quarter. At the same time, a change in timing of catalog expenses due to new revenue recognition standards contributed to an increase in operating costs. All of this resulted in earnings per share that were slightly ahead of our expectations but below last year’s level.

“The fourth quarter has started well, highlighted by solid results during the Black Friday through Cyber Monday period. While we are optimistic about continued strength at Journeys and Johnston & Murphy, the persistent negative comps at Lids and Schuh keep us cautious for the balance of the year, with the greater part of holiday shopping ahead of us. Looking further ahead, we believe the many initiatives we’ve recently executed have the company well positioned to generate increased profitability and deliver greater shareholder value in fiscal 2020.”

Third Quarter Review

Net sales for the third quarter of Fiscal 2019 decreased 1 percent to $713 million from $717 million in the third quarter of Fiscal 2018. Comparable sales increased 4 percent, with stores up 4 percent and direct up 9 percent. Direct-to-consumer sales were 11 percent of total retail sales for the quarter, compared to 10 percent last year.

Third quarter gross margin this year was 49.5 percent compared with 49.4 percent last year.

Selling and administrative expense for the third quarter this year was 45.9 percent, up 90 basis points, compared to 45.0 percent of sales for the same period last year. The increase as a percentage of sales reflects higher bonus accruals and the shift in timing of catalog expenses, partially offset by the leveraging of rents and several other expense categories.

Genesco’s GAAP operating income for the third quarter was $19.5 million this year compared with an operating loss of $152.4 million last year. Adjusted for the Excluded Items in both periods, operating income for the third quarter was $26.0 million this year compared with operating income of $31.3 million last year. Adjusted operating margin was 3.7 percent of sales in the third quarter of Fiscal 2019 and 4.4 percent last year.

The effective tax rate for the quarter was 22.1 percent in Fiscal 2019 compared to -7.1 percent last year. The adjusted tax rate, reflecting Excluded Items, was 25.9 percent in Fiscal 2019 compared to 33.9 percent last year. The lower adjusted tax rate for this year reflects the lower U.S. federal income tax rate following the passage of the Tax Cut and Jobs Act in December 2017, partially offset by the inability to recognize a tax benefit for certain overseas losses.

GAAP earnings from continuing operations were $14.5 million in the third quarter of Fiscal 2019, compared to a loss of $164.8 million in the third quarter last year. Adjusted for the Excluded Items in both periods, third quarter earnings from continuing operations were $18.7 million in Fiscal 2019, compared to earnings from continuing operations of $19.7 million last year.

Cash, Borrowings and Inventory

Cash and cash equivalents at November 3, 2018 were $53.4 million, compared with $50.7 million at October 28, 2017. Total debt at the end of the third quarter of Fiscal 2019 was $81.8 million compared with $223.6 million at the end of last year’s third quarter, a decrease of 63 percent. Inventories decreased 5 percent in the third quarter of Fiscal 2019 on a year-over-year basis.

Capital Expenditures and Store Activity

For the third quarter, capital expenditures were $16 million, which consisted of $10 million related to store remodels and new stores and $6 million related to direct to consumer, omnichannel, information technology, distribution center and other projects. Depreciation and amortization was $19 million. During the quarter, the company opened 15 new stores and closed 19 stores. Excluding Locker Room by Lids in Macy’s stores, the company ended the quarter with 2,534 stores compared with 2,604 stores at the end of the third quarter last year, or a decrease of 3 percent. Square footage was down 2 percent on a year-over-year basis, both including and excluding Lids Locker Room departments in Macy’s stores.

Fiscal 2019 Outlook

For Fiscal 2019, the company is narrowing its previously announced guidance range for adjusted diluted earnings per share and reiterating its expectation that earnings for the year will be near the midpoint of the range. The company expects:

- Comparable sales to be up 2 percent to 3 percent, and

- Adjusted diluted earnings per share in the range of $3.10 to $3.40.

Previously, Genesco expected:

- Comparable sales to be up 1 percent to 3 percent, and

- Adjusted diluted earnings per share in the range of $3.05 to $3.45.

Image courtesy Genesco