20 Feb VF Reports Better-Than-Expected Fourth Quarter

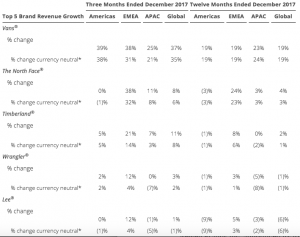

VF Corp. reported better-than-expected results in the fourth quarter as revenue increased 12 percent, or 10 percent currency neutral, driven by broad-based strength across VF’s international and direct-to-consumer platforms, Outdoor & Action Sports coalition and Workwear businesses. On a currency-neutral basis, Vans’ global sales soared 35 percent, The North Face added 6 percent and Timberland increased 8 percent

Highlights include:

- Full year 2017 revenue from continuing operations increased 7 percent to $11.8 billion, including an approximate 2 percentage point revenue growth contribution from the Williamson-Dickie acquisition;

- Full year 2017 reported gross margin from continuing operations increased 120 basis points (up 180 basis points currency neutral) to a record high of 50.5 percent. On an adjusted basis, gross margin increased 100 basis points (up 160 basis points currency neutral) to 50.5 percent;

- Full year 2017 reported earnings per share from continuing operations was $1.79, including a $1.15 per share negative impact from recent U.S. tax legislation. Adjusted earnings per share from continuing operations increased 4 percent to $2.98 (up 7 percent currency neutral) including a $0.04 per share contribution from the Williamson-Dickie acquisition;

- Fourth quarter and full year 2017 earnings per share results include an incremental $0.06 per share ($35 million pretax) impact from additional investments to drive accelerated growth in 2018 and beyond. Relative to the company’s original outlook provided on February 17, 2017, full year 2017 earnings per share included a $0.19 (about $100 million pretax) impact from incremental investments;

- 2017 cash flow from operations reached approximately $1.5 billion and the company returned approximately $1.9 billion to shareholders through dividends and share repurchases; and,

- Revenue and adjusted earnings per share from continuing operations for the transition quarter ending March 31, 2018 are expected to approximate $2.9 billion and $0.65, respectively.

“VF’s fourth quarter results were stronger than we expected as growth continues to accelerate across core dimensions of our portfolio,” said Steve Rendle, chairman and chief executive officer. “We delivered a top-quartile total return for shareholders in 2017 and our strong performance provided us with the capacity to reinvest about $100 million back into our business. I am confident that our investments will accelerate growth and drive even stronger long term value for shareholders. We remain in the early phase of a multi-year journey to become a purpose led, agile, consumer-centric organization. I am pleased with our early progress and look forward to building on our momentum in 2018.”

Discontinued Operations – Nautica Brand Business, Licensing Business and Contemporary Brands

During the fourth quarter of 2017, the company reached the decision to sell its Nautica brand business and determined that it met the held-for-sale and discontinued operations accounting criteria. Accordingly, the company has classified the assets and liabilities of the Nautica brand business as held-for-sale and has included the results of this business in discontinued operations for all periods presented.

On April 28, 2017, the company completed the sale of its Licensed Sports Group (LSG) business, including the Majestic® brand. In conjunction with the LSG divestiture, VF executed its plan to entirely exit the licensing business and completed the sale of the assets of the JanSport brand collegiate business in the fourth quarter of 2017. On August 26, 2016, the company completed the sale of its Contemporary Brands businesses, which included the 7 For All Mankind, Splendid and Ella Moss brands. Accordingly, the company has removed the assets and liabilities of the licensing and the Contemporary Brands businesses as of the dates noted above and included the operating results of these businesses in discontinued operations for all periods presented.

The company’s after-tax net loss from discontinued operations was $17 million in the fourth quarter of 2017, which includes the operating results of the Nautica brand business, a noncash impairment charge to adjust the Nautica® brand business to its estimated fair value, and the gain on sale of the assets of the JanSport brand collegiate business. The company’s after-tax net loss from discontinued operations was $106 million for the full year 2017, which includes the loss on sale of the licensing business, the noncash impairment charges related to the Nautica® brand business and the operating results of the licensing and Nautica brand businesses.

Adjusted Amounts – Excluding Williamson-Dickie and Icebreaker Transaction and Deal Related Expenses and the Impact of U.S. Tax Legislation

This release refers to adjusted amounts that exclude transaction and deal related expenses associated with the acquisition of Williamson-Dickie and Icebreaker®. Total transaction and deal related expenses were $16 million and $21 million in the fourth quarter and full year 2017, respectively.

Adjusted amounts in this release also exclude the impact of recent U.S. tax legislation. On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (“Tax Act”). The Tax Act reduces the federal tax rate on U.S. earnings to 21 percent and moves from a global taxation regime to a modified territorial regime. As part of the legislation, U.S. companies are required to pay a tax on historical earnings generated offshore that have not been repatriated to the U.S. Additionally, revaluation of deferred tax asset and liability positions at the lower federal base rate of 21 percent is also required. The transitional impact of the Tax Act resulted in a provisional net charge of approximately $465 million for the fourth quarter and full year 2017. Given the significant complexity of the Tax Act, anticipated guidance from the U.S. Treasury about implementing the Tax Act, and the potential for additional guidance from the Securities and Exchange Commission or the Financial Accounting Standards Board related to the Tax Act, these estimates may be adjusted during 2018.

Combined, the above charges negatively impacted earnings per share by $1.19 for both the fourth quarter and full year 2017. All adjusted amounts referenced herein exclude the effects of these amounts.

Reconciliations of measures calculated in accordance with GAAP to adjusted amounts are presented in the supplemental financial information included with this release, which identifies and quantifies all excluded items, and provides management’s view of why this information is useful to investors.

Fourth Quarter 2017 Income Statement Review

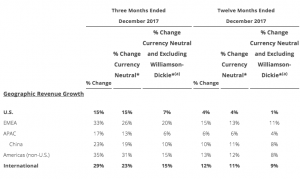

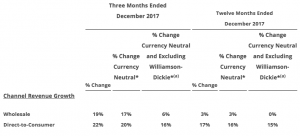

- Revenue increased 20 percent to $3.6 billion (up 18 percent currency neutral), including a $247 million contribution from the Williamson-Dickie acquisition, which closed on October 2, 2017. Excluding the Williamson-Dickie acquisition, revenue increased 12 percent (up 10 percent currency neutral), driven by broad-based strength across VF’s international and direct-to-consumer platforms, Outdoor & Action Sports coalition and Workwear businesses.

- Gross margin improved 130 basis points to a quarterly record high of 51.5 percent, as benefits from pricing, lower restructuring costs, and a mix-shift toward higher margin businesses were partially offset by the Williamson-Dickie acquisition and changes in foreign currency. On an adjusted basis, gross margin increased 60 basis points to 51.6 percent. Excluding the Williamson-Dickie acquisition, adjusted gross margin increased 140 basis points to 52.4 percent. Changes in foreign currency negatively impacted gross margin by 10 basis points.

- Operating income on a reported basis was $481 million. On an adjusted basis, operating income increased 6 percent to $497 million, including a $19 million contribution from the Williamson-Dickie acquisition. Operating margin on a reported basis increased 390 basis points to 13.2 percent. Adjusted operating margin declined 180 basis points to 13.6 percent. Adjusted operating margin, excluding the Williamson-Dickie acquisition, declined 130 basis points to 14.1 percent. Changes in foreign currency negatively impacted operating margin by 30 basis points.

- Fourth quarter loss per share was $0.18 on a reported basis, including a $1.16 negative impact from recent U.S. tax legislation. On an adjusted basis, earnings per share increased 13 percent to $1.01, including a $0.04 contribution from the Williamson-Dickie acquisition. Relative to the company’s outlook provided on October 23, 2017, fourth quarter earnings per share included an incremental $0.06 ($35 million pretax) impact from additional investments to drive accelerated growth in 2018 and beyond.

Fiscal Year 2017 Income Statement Review

- Revenue increased 7 percent to $11.8 billion, including a $247 million contribution from the Williamson-Dickie acquisition. Excluding the Williamson-Dickie acquisition, revenue increased 5 percent (up 4 percent currency neutral), driven by continued momentum in VF’s international and direct-to-consumer platforms, Outdoor & Action Sports coalition and Workwear businesses.

- Gross margin increased 120 basis points to an annual record high of 50.5 percent, as benefits from pricing, lower product and restructuring costs, and a mix-shift toward higher margin businesses were partially offset by changes in foreign currency and the Williamson-Dickie acquisition. On an adjusted basis, gross margin increased 100 basis points to 50.5 percent. Excluding the Williamson-Dickie acquisition, adjusted gross margin increased 120 basis points to 50.7 percent. Changes in foreign currency negatively affected gross margin by 60 basis points.

- Operating income on a reported basis increased 10 percent to $1.5 billion. Adjusted operating income decreased 2 percent to $1.5 billion, including a $19 million contribution from the Williamson-Dickie acquisition. Operating margin on a reported basis increased 30 basis points to 12.7 percent. Adjusted operating margin declined 120 basis points to 12.9 percent. Excluding the Williamson-Dickie acquisition, adjusted operating margin declined 110 basis points to 13.0 percent. Changes in foreign currency negatively impacted operating margin by 50 basis points.

- Earnings per share on a reported basis declined 30 percent to $1.79, including a $1.15 negative impact from recent U.S. tax legislation. Adjusted earnings per share increased 4 percent (up 7 percent currency neutral) to $2.98, including a $0.04 contribution from the Williamson-Dickie acquisition. Relative to the company’s original outlook provided on February 17, 2017, full year 2017 earnings per share included a $0.19 (about $100 million pretax) impact from incremental investments.

Revenue is now expected to increase about 6 percent on a reported basis (up 5.5 percent currency neutral) to approximately $12.1 billion. Adjusted earnings per share are now expected to be $3.01 compared to the previous expectation of $2.96.

Balance Sheet and Cash Flow Highlights

Inventories were up 20 percent compared to 2016 levels. Excluding the Williamson-Dickie acquisition, inventories increased 3 percent. In 2017, VF’s cash flow from operations reached approximately $1.5 billion. The company also returned approximately $1.9 billion to shareholders through dividends and share repurchases.

Fiscal Year Change

As previously disclosed, VF’s Board of Directors authorized a change in the company’s fiscal year end to the Saturday closest to March 31 from the Saturday closest to December 31. This change will be effective March 31, 2018. VF will report results for the transition quarter ending March 31, 2018. The first 12-month fiscal year (Fiscal 2019) will run from April 1, 2018 through March 30, 2019.

Outlook For Transition Quarter Ending March 31, 2018

VF’s outlook for the transition quarter ending March 31, 2018 includes the following:

- Revenue is expected to approximate $2.9 billion, up 16 percent, including about a $200 million contribution from the Williamson-Dickie acquisition. Excluding the Williamson-Dickie acquisition, revenue is expected to increase at a high single-digit rate due in part to changes in foreign currency.

- Adjusted earnings per share is expected to approximate $0.65, up 27 percent, including about a $0.02 contribution from the Williamson-Dickie acquisition. Excluding the Williamson-Dickie acquisition, adjusted earnings per share is expected to increase more than 20 percent due in part to changes in foreign currency.

Dividend Declared

VF’s Board of Directors declared a quarterly dividend of $0.46 per share, payable on March 19, 2018 to shareholders of record on March 9, 2018.

BRAND PERFORMANCE