19 Oct Skechers Q3 Earnings Dip

Skechers USA reported earnings eased 1.7 percent in the third quarter but results came in slightly ahead of a forecast given in July. Sales rose 7.5 percent, led by double-digit growth in both the company’s international wholesale and worldwide company-owned retail businesses but came in below targets.

Third Quarter Highlights

- Record sales of $1.176 billion, an increase of 7.5 percent, or 8.5 percent on a constant currency basis

- International wholesale sales increased 11.8 percent

- Company-owned global retail sales increased 10.6 percent

- Total international wholesale and retail sales combined represented 55.5 percent of total sales

- Diluted earnings per share of $0.58

- Repurchased 1.4 million shares of common stock

“Achieving record third quarter sales is a notable accomplishment given the strength of our third quarter 2017 sales,” began Robert Greenberg, Skechers’ chief executive officer. “Both our domestic and international businesses grew, and we remained the leader in walking, work, casual lifestyle and sandals footwear in the United States. We experienced strong product successes across multiple divisions around the world, which was evident by our double-digit growth in both our international wholesale and worldwide company-owned retail businesses. Skechers D’Lites, our heritage chunky style that has seen great success over the last two years in Asia, is now an in demand style across North America and Europe and is poised for growth in South America, India and the Middle East. Through Skechers D’Lites, we are reaching a younger, more fashion-savvy audience, and getting press—from Marie Claire and Elle to HypeBae and Highsnobiety—and social media influencers are embracing this signature look. Further, we are seeing renewed acceptance of this chunky style by men. Our core footwear categories for men, women, work and golf are also performing well. We are achieving this growth with the right product mix combined with a balanced approach to marketing spend. As we continue to invest in our international infrastructure, we believe there is significant opportunity to grow our brand further through both wholesale and company-owned and third-party retail stores, which now stand at 2,802 locations worldwide. We’re looking forward to fourth quarter growth across both our domestic and international channels and a new annual sales record.”

“As we near the close of 2018, we believe the direction of our business is on target with our record sales in the third quarter, continued international growth and strong gross margins,” stated David Weinberg, chief operating officer of Skechers. “With three record sales quarters in 2018 and brand acceptance around the globe, we achieved a new record for the first nine months of $3.56 billion, an 11.5 percent increase over last year. In the third quarter, our international distributor business returned to growth, increasing 11.6 percent over the same period last year, and combined with our international joint venture and subsidiary business, our total international wholesale sales increased 11.8 percent for the period. International wholesale along with international retail now represents 55.5 percent of our total business. We expect our business in the United States—both wholesale and retail—to grow in the fourth quarter. We remain committed to efficiently and profitably growing our global footwear business.”

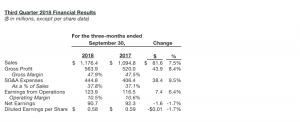

Third Quarter 2018 Financial Results

Sales grew 7.5 percent to $1.17 billion. When it reported second-quarter results on July 21, the company said it expected to achieve sales in the range of $1.200 billion to $1.225 billion.

The gains were a result of an 11.8 percent increase in the company’s international wholesale business and a 10.6 percent increase in its company-owned global retail business.

Its domestic wholesale business decreased 3.0 percent. The company’s total international business grew 12.5 percent and its total domestic business grew 1.8 percent. Third quarter comparable same store sales in company-owned retail stores worldwide increased 1.9 percent, including an increase of 3.0 percent in the United States offset by a decrease of 0.8 percent in its international stores.

Gross margins slightly increased as higher domestic margins from improved retail pricing and product mix were partially offset by the impact of negative foreign currency exchange rates.

SG&A expenses increased 9.5 percent in the quarter. Selling expenses increased by 0.7 percent, but improved 50 basis points as a percentage of sales from 8.2 percent to 7.7 percent for the third quarter 2018. The $37.8 million increase in general and administrative expenses was primarily the result of the company’s continued commitment to build its international brand presence and direct-to-consumer channels. General and administrative expenses in China grew $7.5 million to support continued expansion, including preparation for next month’s Single’s Day, and $13.3 million associated with operating 58 additional company-owned Skechers stores worldwide, of which 13 opened in the third quarter. General and administrative expenses also included $11.1 million related to corporate and domestic operations, of which $4.8 million was for increased domestic warehouse and distribution costs.

Earnings from operations increased $7.4 million, or 6.4 percent.

Net earnings were $90.7 million, and diluted earnings per share were $0.58. When it reported second-quarter results on July 21, the company believes it will achieve diluted earnings per share in the range of 50 to 55 cents.

In the third quarter, the company’s income tax rate was 13.7 percent reflecting its continued assessment of the impact of the recently enacted tax reform legislation. As a comparison, the company’s income tax rate for the three months ended September 30, 2017 was 9.4 percent.

Sales grew 11.5 percent as a result of an 18.9 percent increase in the company’s international wholesale business, and a 13.7 percent increase in its company-owned global retail business. For the nine-month period, its domestic wholesale business was essentially flat compared to the same prior-year period. The company’s combined international wholesale and retail business grew 19.7 percent, and its combined domestic wholesale and retail business increased by 3.4 percent.

Gross margins increased due to strength in the company’s international wholesale and company-owned international retail businesses.

SG&A expenses increased 17.3 percent. This increase was due to an additional $176.3 million in general and administrative expenses. Selling expenses increased by $25.3 million.

Earnings from operations increased $26.9 million, or 8.2 percent.

Net earnings were $253.7 million, and diluted earnings per share were $1.62. For the nine months, the company’s income tax rate was 13.0 percent. As a comparison, the company’s income tax rate for the nine months ending September 30, 2017 was 12.9 percent.

Balance Sheet

At quarter-end, cash, cash equivalents and investments totaled $959.8 million, an increase of $223.4 million, or 30.3 percent from December 31, 2017, and an increase of $156.9 million, or 19.5 percent, over September 30, 2017.

Total inventory, including inventory in transit, was $755.1 million, a $117.9 million decrease from December 31, 2017, and a $57.4 million increase over September 30, 2017. The majority of the year-over-year inventory increase was attributable to international wholesale and global retail, particularly in China.

Working capital was $1.616 billion at September 30, 2018, a $108.4 million increase over December 31, 2017, and a $140.7 million increase over September 30, 2017.

“In the third quarter, we continued to build the Skechers brand worldwide by growing our international wholesale and direct-to-consumer businesses,” began John Vandemore, chief financial officer of Skechers. “We remain committed to investing resources where we see the most significant growth opportunities while also returning cash to shareholders directly by way of share repurchases. We are confident in our strategy to continue growing the Skechers brand across the globe.”

Share Repurchase

During the three months ended September 30, 2018, the company repurchased approximately 1.4 million shares of its Class A common stock at a cost of $40.0 million under its existing share repurchase program. In total, the company has repurchased almost 2.0 million shares of its Class A common stock at a cost of $58.0 million through the first nine months of 2018. At September 30, 2018, approximately $92.0 million remained available under the company’s share repurchase program.

Outlook

For the fourth quarter of 2018, the company believes it will achieve sales in the range of $1.100 billion to $1.125 billion and diluted earnings per share of $0.20 to $0.25. The guidance is based on expected growth in each of the company’s three segments. The company now expects its effective tax rate to be between 13 and 15 percent which implies a fourth quarter tax rate of between 17 and 20 percent.

Photo courtesy Skechers