31 May FDRA Spring Survey Shows Even More Footwear Shoppers Heading Online

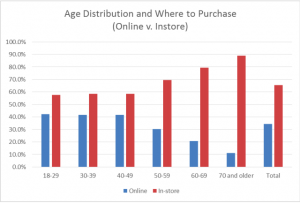

According to the FDRA’s “Spring 2018 National Shoe Sales Survey,” 35 percent of Americans planned to buy shoes online this spring, up from 31 percent in 2017. Amazon was found to be only increasing dominance as the go-to place for purchasing footwear online.

The survey of 755 consumers was conducted by Emerson College Polling Society between April 18 to 22.

For those who do purchase online, 25 percent said what they like most is the price (up from 21 percent in 2017) and 18 percent said the variety. Thirteen percent said it was for convenience and 3 percent said to view the latest trends (all similar to 2017 results).

Of the 35 percent shopping online, a slight uptick was seen in those planning to shop on Amazon, from 47 percent in 2017 to 52 percent in 2018. Footwear-specific online sales site such as Zappos and Shoes.com saw a bounce of 4 percentage points to 15 percent versus 2018.

A slight downtick was seen with those who planned to shop at the shoe brand’s own website, like Nike or Steve Madden, from 16 percent last year to 15 percent. Shoppers who frequent retailer websites like Nordstrom, Foot Locker or Target held at 10 percent. There was a 10-point drop from 17 percent who said they “go somewhere else” in 2017 to 7 percent in 2018.

A healthy majority, 66 percent, still planned to purchase footwear this spring in a physical store, albeit down from 77 percent in 2017.

A healthy majority, 66 percent, still planned to purchase footwear this spring in a physical store, albeit down from 77 percent in 2017.

Of those planning to shop in a store, 53 percent planned to go to a local chain store like DSW or outlet stores, up from 44 percent in 2017. An area of concern is local family-owned shoe stores, which saw a drop from 17 percent of shoppers utilizing them in 2017 to 4 percent in 2018.

Eighteen percent planned to shop at a big box retailer like Target or Walmart, up from 15 percent last year, and 15 percent said a department store, up from 13 percent last year. Eight-percent said somewhere else.

Ensuring proper fit continues to be the main reason they like in-store shopping, was at 50 percent, up from 41 percent in 2017, followed by customer service/help with finding and trying on shoes at 22 percent (down from 32 percent) and convenience/location stayed constant at 20 percent (22 percent last year). Seeing new trends came in fourth at 7 percent, similar to last year, which was at 5 percent.

Twenty-four percent of consumers who planned to purchase shoes this spring reported they don’t buy shoes online.

According to Channel Footwear share data for spring 2018 versus Spring 2017 from SSI Data, the Footwear Retail Segment saw the strongest growth, up 100 basis points; followed by the Department Store Segment, up 30 basis points. Internet share of footwear purchases were flat while Big Box & Mall Specialty was down 110 basis points.

Overall, the FDRA survey encouraging found that 74 percent of consumers planned to buy footwear this spring, with 39 percent saying they plan to spend between $100-$250, a jump over 2017.

Among respondents purchasing shoes, 70 percent said they were buying casual or performance sneakers. Seventeen percent said they were buying fashion/dress shoes like heels, flats or men’s oxfords, while 13 percent said they were buying something else.

SSI Data shows that overall footwear sales grew 1.93 percent for spring 2018. Particularly healthy gains were seen in Outdoor Footwear, ahead 11.2 percent and Casual Athletic Footwear, up 7.0 percent. Athletic Footwear was up 1.1 percent; Casual and Dress Footwear sales remained flat, while Fashion/Dress shoes were up 1.8 percent.

Other findings from the FDRA survey include:

- The most important factors when purchasing shoes this spring season were a tie between the need (39 percent) and the cost (39 percent). In 2017 the need (37 percent) was slightly more important than the cost (30 percent). Adding variety was at 11 percent and keeping up with trends landed at 5 percent, which were almost identical to last year’s numbers regarding variety and trends. Only 6 percent said there was some other reason for the purchase of new footwear, compared to 19 percent in 2017.

- Nearly half of shoe purchasers were planning on spending the same amount as last year, while 29 percent planned to spend less and 22 percent said they plan to spend more. This is a significant difference from 2017, when half of all consumers planned on spending less money (52 percent) and 14 percent planned on spending more.

- In 2018, 48 percent of consumers planned to spend under $100, a 21 percentage point drop from 2017, when 69 percent said they planned to spend under $100. Growth in spending was with the $100-$250 amount, which saw an increase from 23 percent in 2017 to 39 percent in 2018. Thirteen percent said they will spend $250-$500, up from 7 percent, and about 1 percent planned to spend over $500.

The full study is here.

Photo courtesy Amazon