07 Mar Kohl’s Q4 Tops Wall Street’s Targets

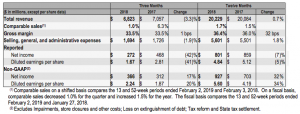

Kohl’s Inc. reported better-than-expected earnings and revenue in the fourth quarter and provided an upbeat outlook for 2019.

Compared to Wall Street’s consensus guidance:

- Adjusted earnings of $2.24 per share beat expectations of $2.18.

- The 1 percent comp gain was above the 0.3 percent Wall Street expected.

- Net revenue of 6.82 billion topped Wall Street’s consensus target of $6.58 billion

“The positive momentum we’ve had all year continued as we achieved a 1 percent comp sales increase for the fourth quarter, resulting in a 1.7 percent increase for the year,” said Michelle Gass, Kohl’s chief executive officer. “Building on the exceptional holiday we had in 2017, we’ve now achieved a 7 percent increase in the fourth quarter on a two-year basis.”

“With a clear focus on driving traffic and operating with discipline, the company is delivering sales growth while also improving profitability. We are financially strong and our overall health in the business is positioning us well for continued success,” Gass continued. “I want to thank all of our Kohl’s associates for another successful year of strong execution and great performance. Moreover, I thank them for their commitment to providing an engaging, enjoyable experience to our customers.”

Operational Update

As the company disclosed in an SEC filing in early January, it took several actions in the fourth quarter as part of its Operational Excellence initiatives. The company will close four underperforming stores in April, but will open four new smaller format stores later in the year. It is consolidating call center locations which support both its Kohl’s Charge and online customers. Additionally, the company offered a voluntary retirement program to qualified hourly associates and impaired certain assets.

These actions are expected to generate annual SG&A savings of approximately $20 million dollars and annual depreciation savings of approximately $5 million dollars. The company incurred $104 million dollars in pretax charges in the fourth quarter as a result of these actions and estimate that approximately $50-55 million dollars of additional charges will be recorded in the first quarter of 2019. Most of the 2019 charges will be related to future lease commitments at the four stores that will be closing.

Additionally, the company retired $413 million dollars of debt in the fourth quarter and reported a $21 million dollar loss on extinguishment of debt. Combined with the tender offer in the first quarter and additional open market debt repurchases, the company reduced its outstanding debt by over $900 million dollars and extended the remaining maturity of the portfolio an additional two years. The debt reduction is expected to decrease annual interest expense by approximately $45 million dollars.

Dividend

On February 27, 2019, Kohl’s Board of Directors declared a quarterly cash dividend on the company’s common stock of $0.67 per share, a 10 percent increase over its prior dividend. The dividend is payable April 3, 2019 to shareholders of record at the close of business on March 20, 2019.

Store Update

Kohl’s ended the fiscal year with 1,159 Kohl’s stores in 49 states. During 2018, the company opened one Kohl’s store and relocated two Kohl’s stores.

Initial 2019 Earnings Guidance

The company expects earnings per diluted share of $5.80 to $6.15 for fiscal 2019. That’s above Wall Street’s consensus target of $5.77. This guidance is based on the following assumptions which includes the impact of the new lease standard, but excludes any non-recurring charges:

- Comparable sales change of 0 percent to 2.0 percent

- Gross margin as a percentage of sales increase up to 10 basis points over 2018

- SG&A dollars increase 1 percent to 2 percent over 2018. Excluding the impact of lease accounting, SG&A dollars are expected to increase 0.5 percent to 1.5 percent

- Depreciation expense of $930 million, which includes a $25 million dollar benefit from lease accounting

- Interest expense of $200 million, which includes a $10 million dollar benefit from lease accounting

- Effective tax rate of 24 percent to 25 percent

- Share repurchases of $400-$500 million