14 Feb Skechers Tops Q4 Targets On Robust International Growth

Skechers USA, Inc. reported earnings on an adjusted basis grew 42.3 percent, easily topping Wall Street’s targets, as sales gained 11.4 percent.

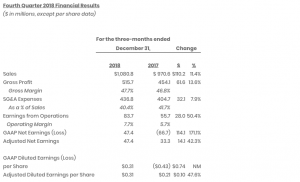

Fourth Quarter Highlights

- Record fourth quarter sales of $1.08 billion, an 11.4 percent increase, or 13.7 percent on a constant currency basis

- International wholesale sales increase 18.4 percent

- Company-owned global retail sales increase 7.5 percent

- Total international wholesale and retail sales combined represented 55.6 percent of total sales

- Earnings from operations of $83.7 million, an increase of 50.4 percent

- Diluted earnings per share of $0.31

- Repurchased 1.7 million shares of Class A common stock

“In 2018, our mindset was to seek new growth opportunities by comprehensively evaluating our domestic and international businesses while drilling down to specific regions and channels of distribution,” began Robert Greenberg, chief executive officer of Skechers. “These opportunities were across our product lines with proven styles, new designs and collaborations, and in select regions where we saw great potential. Product highlights included the resurgence of our heritage Skechers D’Lites collection, which continues to gain momentum around the world, our iconic Skechers GOwalk line, and our comfortable and easy-to-wear men’s slip-ons, among others. With the strength of our products, we remain the number one lifestyle casual, dress casual, walking and work brand in the United States. We also focused on growing our online business around the world—improving the functionality of our ecommerce sites in the United States and China, and launching an ecommerce platform in India, while also increasing our global retail footprint, ending 2018 with 2,998 Skechers company-owned and third party-owned stores. Additionally, we began delivering Spring 2019 product with the relevant marketing support, and we also started our Fall/Winter 2019 meetings with key accounts. We are looking forward to what we believe will be a new first quarter sales record.”

“2018 was a year of record sales—our first fourth quarter of over a billion dollars and, combined with three previous record quarters, a new annual sales record of $4.64 billion,” stated David Weinberg, chief operating officer of Skechers. “For the quarter, this growth was fueled by double-digit sales increases in each of our international businesses—company-owned retail, distributor, subsidiary and joint venture, and by single digit sales increases in both our domestic wholesale and retail businesses. For the year, we achieved double-digit sales increases across our international portfolio and single-digit sales increases in our total domestic business. In 2018, we also shipped a record number of pairs from our distribution centers across South America, North America, Japan and Europe, which is a testament to the strength of our global operations and the breadth of our international sales, which represented 54.0 percent of our total business for the year.”

Weinberg continued: “Our international business represents our most significant growth opportunity. To maximize on that opportunity in two key areas, we recently completed the transition of our India joint venture to a wholly owned subsidiary and reached an agreement in principle to establish a joint venture in Mexico with our current distribution partner. We expect these strategic investments to be accretive to our diluted earnings per share in 2019. Additionally, we continue to invest in infrastructure—we broke ground on our new distribution center in China in the fourth quarter as well as on the expansion of our global headquarters in Manhattan Beach in January. We remain focused on efficiently and profitably growing our business for the future.”

For the fourth quarter, sales grew 11.4 percent as a result of an 18.4 percent increase in the company’s international wholesale business, a 7.5 percent increase in its company-owned global retail business, and a 4.8 percent increase in its domestic wholesale business. The company’s international business grew 17.9 percent and its domestic business grew 4.1 percent. Fourth quarter comparable same store sales in company-owned retail stores, including ecommerce, increased 1.1 percent, which included an increase of 3.0 percent in its international stores and 0.4 percent in the United States.

Gross margins increased 90 basis points to 47.7 percent as higher domestic margins from improved retail pricing and product mix was partially offset by the negative impact of foreign currency exchange rates.

SG&A expenses increased 7.9 percent in the quarter. Selling expenses decreased $2.0 million or 3.2 percent, and improved as a percentage of sales by 90 basis points from 6.6 percent to 5.7 percent. General and administrative expenses increased $34.2 million, but improved 40 basis points as a percentage of sales from 35.1 percent to 34.7 percent. General and administrative expenses grew $8.8 million in China to support its continued expansion, and grew $9.4 million in retail from 47 additional company-owned Skechers stores worldwide, of which 11 opened in the fourth quarter. General and administrative expenses also grew $9.7 million in domestic and corporate operations.

Earnings from operations increased $28.0 million, or 50.4 percent.

Net earnings were $47.4 million and diluted earnings per share were $0.31. The company’s income tax rate was 18.4 percent. In the fourth quarter of 2017, the Tax Cuts and Jobs Act (“TCJA”) resulted in a discrete income tax expense of $99.9 million, or $0.64 per diluted share. As a result, the company’s reported tax rate was 194.4 percent for the fourth quarter of 2017, and 38.8 percent for the full year. Excluding this discrete item, the company’s tax rate would have been 12.2 percent for the fourth quarter and 12.8 percent for the full year.

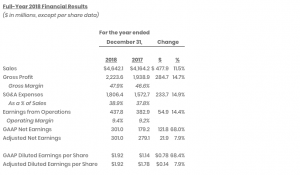

For the full year, sales grew 11.5 percent as a result of an 18.8 percent increase in the company’s international wholesale business, a 12.0 percent increase in its company-owned global retail business, and a 0.8 percent increase in its domestic wholesale business. The company’s international business increased 19.2 percent and its domestic business increased by 3.5 percent. For the full year, comparable same store sales in company-owned retail stores, including ecommerce, increased 9.2 percent, including an increase of 16.7 percent in its international stores, and an increase of 6.7 percent in the United States.

Gross margins improved 130 basis points driven by strength in the company’s international joint venture and subsidiary businesses, and company-owned domestic retail stores.

SG&A expenses increased 14.9 percent. Selling expenses increased $23.2 million or 7.1 percent but improved 30 basis points as a percentage of sales from 7.9 percent to 7.6 percent. General and administrative expenses increased $210.5 million as a result of the company’s continued commitment to build its global infrastructure and direct-to-consumer channels.

Earnings from operations increased $54.9 million, or 14.4 percent.

Net earnings were $301.0 million and diluted earnings per share were $1.92. For the full year, the company’s income tax rate was 14.0 percent.

Balance Sheet

At year-end, cash, cash equivalents and investments totaled $1.07 billion, an increase of $312.2 million, or 41.4 percent from December 31, 2017.

Total inventory, including inventory in transit, was $863.3 million, a $9.8 million or 1.1 percent decrease from December 31, 2017.

Working capital was $1.62 billion at December 31, 2018, a $114.2 million increase over December 31, 2017.

“In the fourth quarter, our strategy continued to yield strong results,” began John Vandemore, chief financial officer of Skechers. “Despite significant foreign currency headwinds, we grew our international businesses, and domestically, the strength of our product continued to deliver growth. We also executed against our capital allocation plan. In 2018, we returned $100.0 million to shareholders in the form of share repurchases, while also investing in the necessary infrastructure to support our growing business.”

Share Repurchase

During the three months ended December 31, 2018, the company repurchased approximately 1.7 million shares of its Class A common stock at a cost of $41.9 million under its existing share repurchase program. In total, the company has repurchased almost 3.7 million shares of its Class A common stock at a cost of $100 million through the full year in 2018. At December 31, 2018, approximately $50.0 million remained available for buying back shares under the company’s share repurchase program.

Outlook

For the first quarter of 2019, the company believes it will achieve sales in the range of $1.275 billion to $1.300 billion, and diluted earnings per share of $0.70 to $0.75. These amounts include the impact of existing foreign exchange rates and a shift in some sales between the first quarter and second quarter due to the timing of Easter in late April 2019. Skechers expects that its annual effective tax rate in 2019 will be in the range of 14 percent to 18 percent.