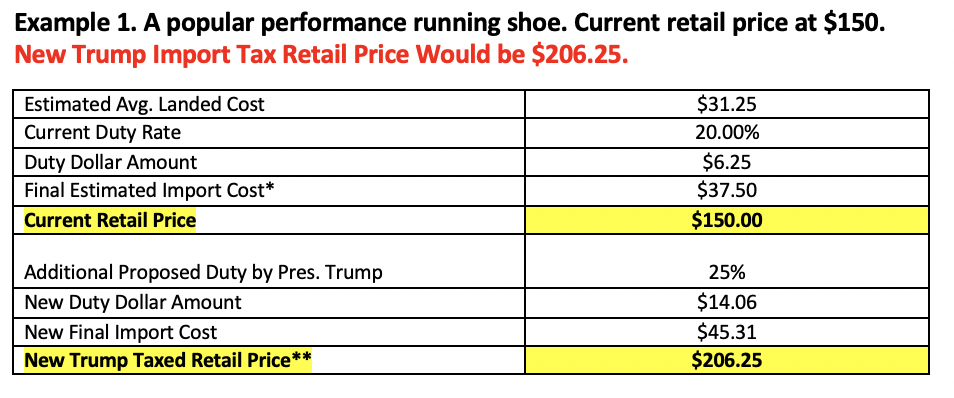

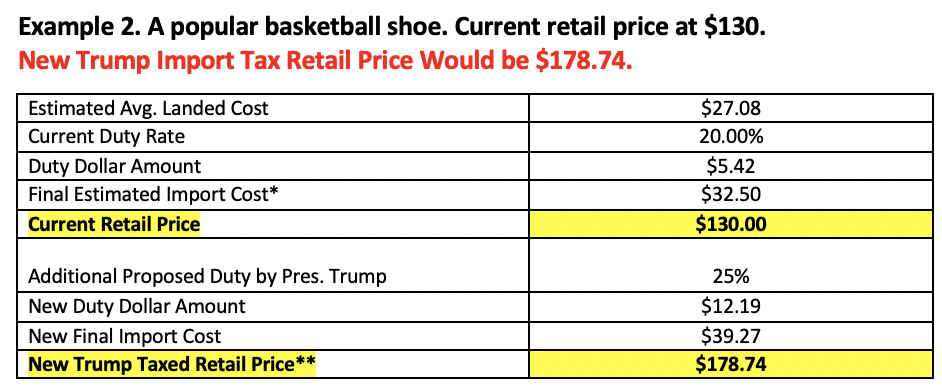

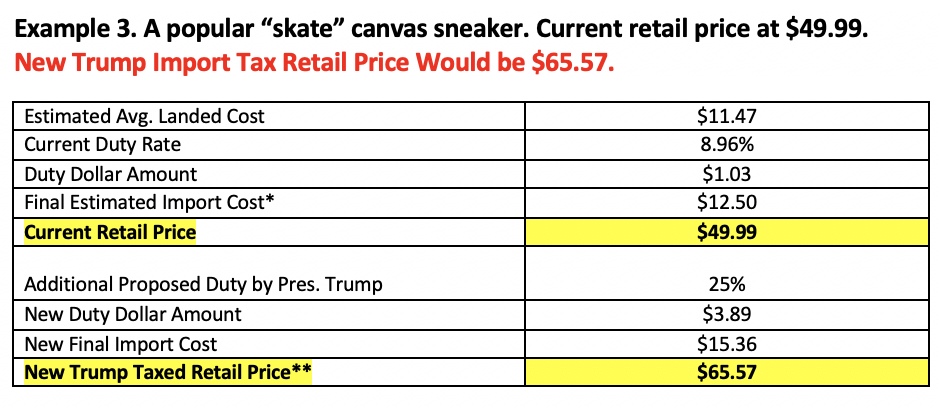

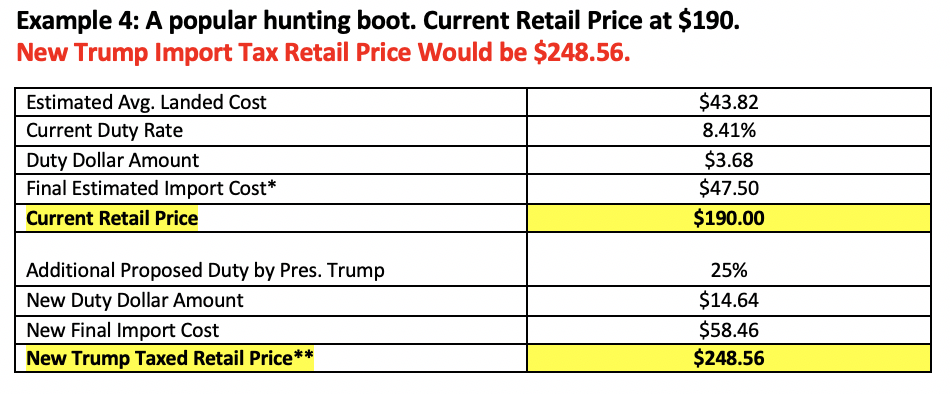

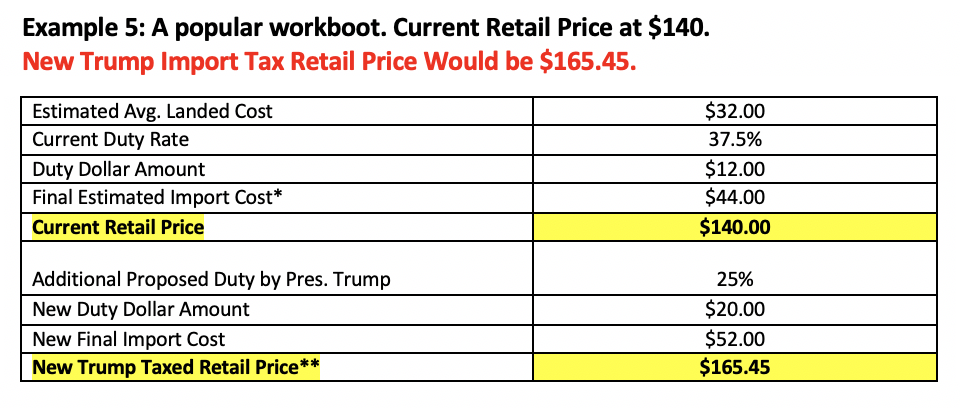

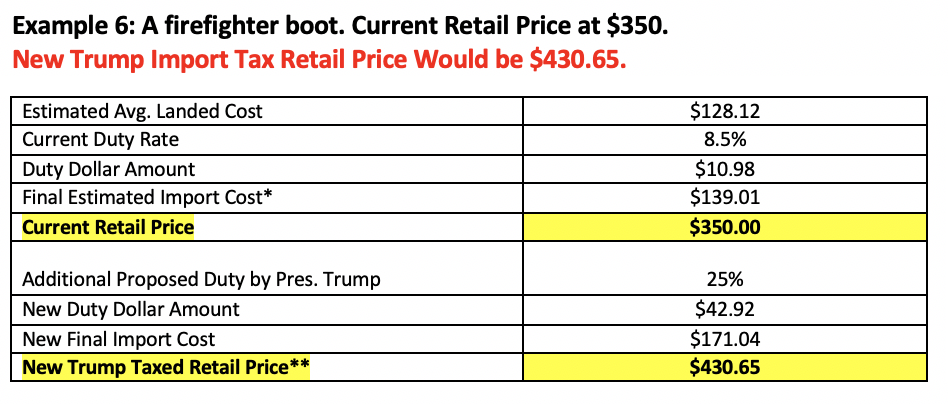

President Trump’s Proposed 25% Import Tax Increase Would Be Catastrophic for Footwear Consumers and Companies

FDRA calculated the cost increases on current popular shoe styles sold in America should President Trump increase tariffs by another 25%. Footwear already pays some of the highest duties on any imported good, upwards of 67.5%. Another 25% on top would cause price spikes resulting in large sales decreases and job losses in the thousands.