21 Jan 60 Seconds on Sourcing with TATA’s N Mohan

60 Second on Sourcing is FDRA’s new effort to help footwear sourcing professionals hear best practices and get unique insights about sourcing trends from leading experts in under 60 seconds.

Q. US. Footwear imports from India are up almost 20% year-to-date, what do you think are some of the Indian footwear industry’s biggest strengths? What might account for this growth?

A. The US is a focus market for India and the Indian export industry is collectively making major strides, more so, to overcome geographical risk. Traditionally, India focused on Europe and it is a well-known fact that European markets have slowed over the last few years.

Recently industry experts had a brain storming session to meet the new export target of $10 billion by FY2017 set by the government of India. The unanimous opinion of industry leaders was that India as a country, must focus more on USA. The second strong view was that 70% of this needed to come from footwear and leather goods.

Footwear will provide the much needed thrust for boosting exports. India has a huge raw material base and the shoe industry has its origins in the leather industry. India therefore has a huge competitive advantage in all leather footwear products. Due to this, many American brands such as Cole Haan, Johnston and Murphy and Wolverine, etc., are actively sourcing from India. Observe that the average export price of Indian footwear into USA is $22/pair compared to $13.90 which is the average price of exports. This is due to the fact US companies consider India as a source for all leather products.

Q. Historically India has excelled in manufacturing only certain types of footwear, mainly leather, what’s keeping the industry from providing the US. Market with other types of footwear?

“It imperative to understand the growth of the Indian leather industry. The Indian industry graduated to different levels, starting from being exporters of raw materials. Thereafter, it graduated into finished leather from semi-finished leather and then into shoe upper exports, eventually moving into full shoes. The footwear industry primarily focused on leather based products. 82 % of the footwear exported consists of leather, however over the last few years there has been a focus on non-leather footwear. Major brands like Nike, Adidas, Reebok have started making shoes for export markets and they have been growing rapidly.

Today, India offers a fantastic opportunity for sports footwear, provided the brands are willing to explore new regions like central India, as the tendency has been to concentrate on clusters like Chennai and nearby Chennai areas or the northern areas like Agra, Kanpur and Delhi. If we concentrate on areas where there is abundant employable labor availability rather than focusing on traditional footwear areas, a lot of benefits can be had.

India lacks good quality synthetics and other components which contribute to the lack of growth in non-leather footwear. However there is again a thrust from the industry to grow this sector. To summarize, India offers enormous potential to non-leather footwear provided we can set up a comprehensive cluster. In fact there are excellent grants and investment subsidies available from the government and also training subsidies which can help grow this sector.

Q. What can US Footwear companies and brands expect out of the Indian footwear industry in the coming five years?

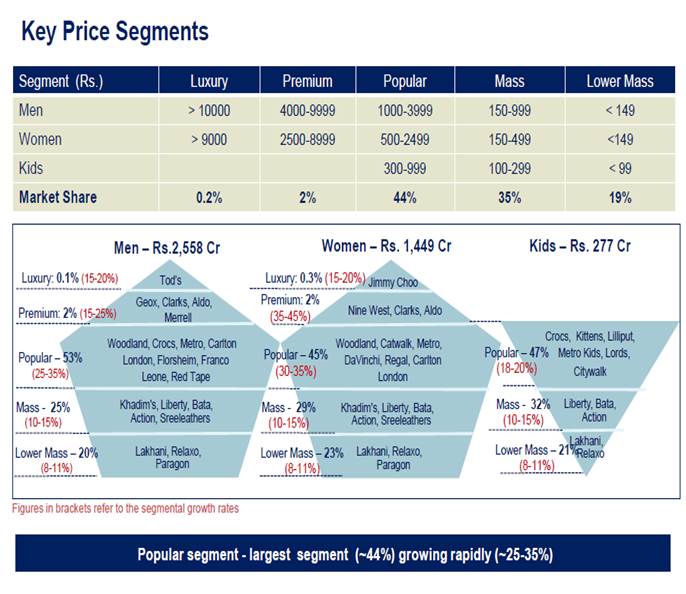

With a consumption of close to 2.2 billion pairs with increasing disposable income and with more than 70% of the population less than 30 years of age, India offers a phenomenal opportunity to brands, to market them. The Indian market opportunity can be described as under :

To summarize, in the next five years we expect all major international brands to be in India, to service the aspiring and burgeoning middle-class population. Worldwide, the footwear industry follows the trends of the apparel industry. Major apparel brands are present in India today, as well as fashion retailers like Zara and Mango. India will be a fantastic opportunity in the years to come.