23 Jun Here’s what’s really happening in US Athletic footwear: May 2016

Here’s what’s really happening in US athletic footwear for May 2016.

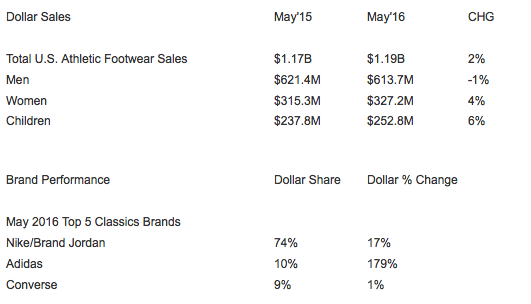

It was another decent, but not great month for U.S. athletic footwear. Both dollar and unit sales grew by 2 percent in May 2016 compared to May 2015, while average selling price was down 1 percent.

May is a transition period for the athletic footwear industry, when retailers clear old stock to prepare for the back-to-school season.

In terms of brand highlights, Adidas continued its strong performance, with sales up nearly two-thirds for the month. Adidas gained 240 basis points in share to 6 percent, driven by gains in casual, classics, and running. Puma sales grew more than 40 percent, with particular strength in the women’s market. Under Armour footwear sales grew by more than half, as its basketball business improved nearly fivefold, despite a decline in the performance basketball category overall.

By category, classics continued to lead the sales gains for the athletic footwear industry, up by 22 percent. Particularly, almost every major brand in retro running experienced nice growth.

Casual athletic grew 4 percent for the month, with Adidas up about two-thirds. Converse’s casual athletic business improved by about 50 percent.

Running sales declined 2 percent for May as the casual running trend could not offset the loss in performance running. Adidas running grew more than 50 percent, while Under Armour improved in the mid-teens. The major tech running brands declined for May.

Cross-training declined 10 percent, while the walking category improved from previous trend and grew by one percent.