07 Mar Urban Outfitters’ Q4 Earnings Tops Wall Street’s Target

Urban Outfitters Inc. reported income on an adjusted basis rose 20.2 percent to $90.2 million, or 83 cents a share, from $75.0 million, or 69 cents, a year ago. Wall Street’s consensus estimate was 78 cents.

Net income in the period came to $86.4 million, or 80 cents, in the latest period versus earnings of $1.3 million, or 1 cent, the prior year. The significantly lower year-ago net earnings primarily reflects the impact of tax reform.

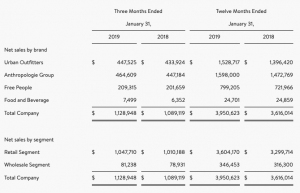

Total company net sales for the three months ended January 31, 2019, increased 3.7 percent over the same period last year to a record $1.13 billion. Comparable Retail segment net sales increased 3 percent, driven by double-digit growth in the digital channel, partially offset by negative retail store sales. By brand, comparable Retail segment net sales increased 4 percent at Free People, 4 percent at Urban Outfitters and 2 percent at the Anthropologie Group. Wholesale segment net sales increased 3 percent.

For the year ended January 31, 2019, total company net sales increased to $4.0 billion, or 9.3 percent, over the prior year. Comparable Retail segment net sales increased 8 percent, driven by double-digit growth in the digital channel and positive retail store sales. Wholesale segment net sales increased 10 percent.

“The fourth quarter closed what was an incredibly successful year for URBN and all of our brands,” said Richard A. Hayne, Chief Executive Officer. “I want to thank our associates worldwide for producing a record year and for their dedication, drive and creativity,” finished Hayne.

Net sales by brand and segment for the three and twelve-month periods were as follows:

For the three months ended January 31, 2019, the gross profit rate improved by 172 basis points and the adjusted gross profit rate improved by 99 basis points versus the prior year’s comparable period. The increase in adjusted gross profit rate was primarily driven by better maintained margin from lower markdown rates and improved initial mark-ups. Anthropologie delivered the most significant improvement, followed by Urban Outfitters. Store occupancy also leveraged due in part to the positive comparable Retail segment net sales.

For the year ended January 31, 2019, the gross profit rate improved by 158 basis points versus the prior year’s comparable period. The improvement in gross profit rate was driven by lower markdowns at all three brands and leverage in store occupancy cost due to Retail segment comparable net sales.

As of January 31, 2019, total inventory increased by $19.1 million, or 5.4 percent, on a year-over-year basis. Comparable Retail segment inventory increased 3 percent at cost.

For the three months ended January 31, 2019, selling, general and administrative expenses increased by $8.5 million, or 3.4 percent, compared to the prior year’s comparable period. For the three months ended January 31, 2019, adjusted selling, general and administrative expenses, increased by $10.5 million, or 4.2 percent, compared to the prior year’s comparable period and expressed as a percentage of net sales, deleveraged 13 basis points. For the year ended January 31, 2019, selling, general and administrative expenses increased by $49.8 million, or 5.4 percent, compared to the prior year’s comparable period and expressed as a percentage of net sales, leveraged 88 basis points. The leverage for the year ended January 31, 2019, was primarily driven by the net sales growth and further benefited from continued savings associated with the fiscal 2018 store reorganization project and the nonrecurring store reorganization expenses incurred in the prior year. The dollar growth in selling, general and administrative expenses in both periods was primarily due to increased direct selling and marketing expenses to support and drive the increase in Retail segment net sales and higher bonus and share-based compensation expense.

The company’s effective tax rate for the three months ended January 31, 2019, was 25.1 percent compared to 98.6 percent in the prior year period. The effective tax rate for the year ended January 31, 2019, was 22.7 percent compared to 58.6 percent in the prior year comparable period. The decrease in the effective tax rate for the three months and year ended January 31, 2019, was primarily due to a one-time tax expense of $64.7 million related to the comprehensive United States tax legislation commonly referred to as the Tax Cuts and Jobs Act (“Tax Act”) in the fourth quarter of fiscal 2018. This non-recurring tax expense was due to the deemed repatriation transition tax on our unremitted foreign earnings and the revaluation of our net U.S. deferred tax assets as a result of the lower federal rate enacted as part of the Tax Act.

Net income for the three months and year ended January 31, 2019, was $86 million and $298 million, respectively, and earnings per diluted share was $0.80 and $2.72, respectively.

On August 22, 2017, the company’s Board of Directors authorized the repurchase of 20 million common shares under a share repurchase program, of which 14.4 million common shares were remaining as of January 31, 2019. During the year ended January 31, 2019, the company repurchased and subsequently retired 3.5 million common shares for approximately $121 million under this program. During the year ended January 31, 2018, the company repurchased and subsequently retired 2.1 million common shares for approximately $46 million under this program. Additionally, during the year ended January 31, 2018, the company repurchased and subsequently retired 6.0 million common shares for approximately $111 million under a share repurchase program authorized by the company’s Board of Directors on February 23, 2015, completing such share repurchase program in August 2017.

During the year ended January 31, 2019, the company opened a total of 18 new retail locations including: 6 Free People stores, 5 Urban Outfitters stores, 4 Anthropologie Group stores and 3 Food and Beverage restaurants; and closed 11 retail locations including: 5 Urban Outfitters stores, 3 Anthropologie Group stores and 3 Free People stores. During the year ended January 31, 2019, 5 franchisee-owned stores were opened including: 4 Urban Outfitters stores and 1 Free People store.

Urban Outfitters’ portfolio is comprised of 245 Urban Outfitters stores in the United States, Canada and Europe and websites; 227 Anthropologie Group stores in the United States, Canada and Europe, catalogs and websites; 135 Free People stores in the United States, Canada and Europe, catalogs and websites, 13 Food and Beverage restaurants, 4 Urban Outfitters franchisee-owned stores and 1 Free People franchisee-owned store, as of January 31, 2019. Free People, Anthropologie Group and Urban Outfitters wholesale sell their products through approximately 2,200 department and specialty stores globally as well.