25 Oct Puma Lifts 2019 Outlook As Q3 Profit And Revenues Climb

Puma raised its earnings guidance for the year as strong third-quarter earnings and overall momentum is expected to offset the negative impact from new tariffs in the fourth quarter in the U.S. Q3 sales grew 17.0 percent on a currency-neutral basis, led by a 28.5 percent gain in the Asia/Pacific region and a 17.9 percent climb in the Americas region.

2019 Third-Quarter Facts

- Sales increase by 17.0 percent currency adjusted to €1,478 million (+19.0 percent reported) with continued growth in all regions and product divisions

- Gross profit margin improves to 49.7 percent

- Operating expenses (OPEX) increase 18 percent (reported) due to higher sales related costs as well as higher marketing and retail investments

- Operating result (EBIT) up by 25 percent to €162 million

Puma opens its first ever North American flagship store on Fifth Avenue in New York - At the World Athletics Championships in Doha (Qatar), Puma athlete Karsten Warholm defends his title over 400m hurdles; overall, the 12 Puma-sponsored federations and 115 athletes competing in Doha ensured a high level of visibility for the brand

- Puma signs the Morocco national football federation

- Puma adds RJ Barrett from the New York Knicks and Kyle Kuzma from the Los Angeles Lakers to its growing roster of NBA players

2019 Nine-Months Facts

- Sales increase by 16.0 percent currency adjusted to €4,024 million (+17.6 percent reported)

- Gross profit margin up by 60 basis points at 49.4 percent

- Operating expenses (OPEX) increase by 17 percent (reported) at a slightly lower rate than reported sales

- Operating result (EBIT) improves by 28 percent from €300 million to €385 million and EBIT-margin increases from 8.8 percent to 9.6 percent

- Net earnings increase by 39 percent from €176 million last year to €245 million and earnings per share increase from €1.18 last year to €1.64 correspondingly

Bjørn Gulden, Chief Executive Officer of Puma SE, said, “The third quarter developed very positively for us and ended as the best quarter that Puma has ever achieved – both in terms of revenue and EBIT. Double-digit sales growth in all divisions and almost in all regions (EMEA “only” 9.7 percent) underlines the favorable development of our brand. Especially positive for me was the 17 percent growth in Footwear, which shows the strong performance of the new styles, and EMEA’s growth of almost 10 percent, proving a good recovery in Europe. The fourth quarter will be the first quarter where the US tariffs on China will have an impact. Currently, without price increases, this is putting pressure on EBIT, at least in the short-term. Nevertheless, the good development in the third quarter and the outlook for the fourth quarter allows us to look at a sales growth of around 15 percent currency adjusted and an EBIT between €420 million and €430 million for the full year 2019.”

Sales Development

Third Quarter 2019

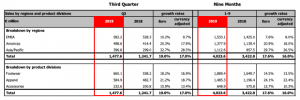

Puma’s strong sales growth continued in the third quarter of 2019. Sales increased by 17.0 percent currency adjusted to €1,477.6 million (+19.0 percent reported). The Asia/Pacific and Americas regions continued to contribute with double-digit increases, while growth in the EMEA region was at a high single-digit rate. Footwear, Apparel and Accessories all showed strong growth in the third quarter, improving by 16.9 percent, 18.7 percent and 13.4 percent respectively. Sportstyle, Motorsport, Golf and Running and Training were the categories with the highest growth rates.

The gross profit margin improved to 49.7 percent in the third quarter (last year: 49.6 percent). Small positive mix effects as well as slightly beneficial hedging led to margin improvements.

Operating expenses (OPEX) rose by 18.1 percent to €578.5 million in the third quarter. The increase was mainly caused by higher sales-related variable costs, including logistics costs as well as higher marketing and retail investments, while the remaining OPEX only rose moderately.

The operating result (EBIT) increased by 24.8 percent from €129.9 million last year to €162.2 million due to a strong sales growth combined with an improved gross profit margin and operating leverage. This corresponds to an improvement of the EBIT-margin from 10.5 percent last year to 11.0 percent in the third quarter 2019.

Net earnings increased by 29.7 percent from €77.5 million to €100.5 million and earnings per sharewere up from €0.52 in the third quarter last year to €0.67 correspondingly.

Nine Months 2019

Sales in the first nine months of 2019 rose by 16.0 percent currency adjusted to €4,023.6 million (+17.6 percent reported). The strong sales development was largely driven by double-digit growth rates in Asia/Pacific, where China continued to be the main growth driver, and the Americas. EMEA grew at a high single-digit rate. The growth was driven by double-digit growth in all divisions: Footwear grew 13.5 percent, Apparel expanded by 22.4 percent, and Accessories increased by 10.3 percent.

Wholesale continued to drive growth with an increase of 14.5 percent currency adjusted, supported by a strong performance of our key accounts. Puma’sdirect-to-consumer sales(owned and operated retail stores and eCommerce)increased by 21.3 percent currency adjusted to €947.3 million. This was driven by like-for-like sales growth in our own stores, the expansion of our retail store network and a continued strong growth of our eCommerce business. Direct-to-consumer sales represented a share of 23.5 percent of total sales for the first nine months of 2019 (22.5 percent in the previous year).

The gross profit margin improved by 60 basis points from 48.8 percent to 49.4 percent in the first nine months of 2019. Positive impacts from regional, channel and product mix, lower discounts as well as slightly positive currency impacts led to margin improvements.

Operating expenses (OPEX) increased by 17.2 percent and amounted to €1,620.7 million. The increase was driven by higher sales-related variable costs as well as continued investments in IT infrastructure, marketing and our own retail business.

The operating result (EBIT) grew by 28.4 percent from €299.8 million last year to €385.0 million in the first nine months of 2019 due to a strong sales growth combined with an increased gross profit margin and a slight operating leverage. This led to an improved EBIT-margin of 9.6 percent compared to 8.8 percent in the first nine months last year.

Net earnings rose by 39.0 percent to €244.6 million (last year: €176.0 million). This translates into earnings per shareof €1.64 compared to €1.18 in the first nine months of 2018.

Working Capital

Inventories were up by 28.4 percent at €1,140.8 million. Earlier purchase of products to balance supplier capacities and secure product availability, more retail stores in operation and the general sales growth led to the increase. In the third quarter, the latest currency developments as well as an increased front-loading of product for the United States prior to tariff increases further added to the development. Trade receivables rose by 13.1 percent to €794.8 million. On the liabilities side, trade payables were up by 23.0 percent to €722.1 million. This resulted in an increase of working capital by 20.1 percent to €915.7 million.

Outlook 2019

The third quarter saw a continued strong increase in sales and profitability. Based on this and our expectations for the fourth quarter, we slightly adapt our guidance for the full year 2019. Puma now expects that currency adjusted sales will increase around 15 percent (previous guidance: currency adjusted increase of around 13 percent). The gross profit margin is still anticipated to improve slightly (2018: 48.4 percent) and we continue to expect that operating expenses (OPEX) will increase at a slightly lower rate than sales. As a consequence, we expect the operating result (EBIT) to come in between €420 million and €430 million, despite the negative impact from new tariffs in the fourth quarter in the United States (previous guidance: between €410 million and €430 million). In line with the previous guidance, management expects that net earnings will improve significantly in 2019.