10 Dec Genesco Lifts Full-Year Guidance On Journeys’ Q3 Momentum

Genesco Inc. raised its outlook for the year after reporting third-quarter profit and same-store sales rose above expectations.

Third Quarter Fiscal 2020 Financial Summary

- Net sales were flat at $537 million

- Comparable sales increased 3 percent

- GAAP EPS from continuing operations increased to $1.31 vs. $1.00 last year

- Non-GAAP EPS from continuing operations increased to $1.331 vs. $0.97 last year

Genesco Inc. reported GAAP earnings from continuing operations per diluted share of $1.31 for the three months ended November 2, 2019, compared to $1.00 in the third quarter last year. Adjusted for the excluded items in both periods, the company reported third-quarter earnings from continuing operations per diluted share of $1.33 compared to $0.97 per diluted share last year and Wall Street’s consensus estimate of $1.08.

Robert J. Dennis, Genesco chairman, president and chief executive officer, said, “Our third quarter results meaningfully exceeded our expectations. Consolidated comparable sales increased 3 percent driven by the ongoing strength of our Journeys business, coupled with a much improved performance from Schuh in the U.K. The third quarter represented our tenth consecutive quarter of positive comparable sales for our footwear businesses and included digital comp growth of almost 20 percent as well as our ninth consecutive quarter of positive store comps. At the same time, higher gross margins at each of our divisions combined with our aggressive share repurchase activity over the past several months helped to achieve a 37 percent increase in adjusted earnings per share versus a year ago.

“The fourth quarter has started well, highlighted by solid results during the Black Friday through Cyber Monday period versus the comparable period last year. Based on our strong third quarter results and positive start to the holiday season, we are raising our full-year guidance. We now expect earnings per share for Fiscal 2020 to be between $4.10 to $4.40, with an expectation that earnings for the year will be near the mid-point of the range, up from our previous range of $3.80 to $4.20. Our year-to-date performance highlights the success we are having as a footwear-focused company. Looking ahead, we believe the strong market positions occupied by each of our footwear businesses provide us with compelling future growth prospects which we are committed to capitalizing on to generate greater value for our shareholders.”

Third Quarter Review

Net sales for the third quarter of Fiscal 2020 were flat at $537 million compared to the third quarter of Fiscal 2019. Sales were short of Wall Street’s consensus estimate of $540.6 million,

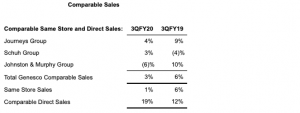

Excluding the effect of lower exchange rates, net sales would have increased $2 million compared to last year. Comparable sales increased 3 percent, with stores up 1 percent and direct up 19 percent. Direct-to-consumer sales were 11.4 percent of total retail sales for the quarter, compared to 9.6 percent last year.

Same-store sales growth of 3 percent beat expectations of a 1.5 percent rise.

Third quarter gross margin this year was 49.2 percent, up 70 basis points, compared with 48.5 percent last year. The increase as a percentage of sales reflects higher initial margins and decreased markdowns for Journeys Group, improved margin in both sale and full price product at Schuh Group and a higher mix of direct to consumer sales and improved wholesale gross margin in Johnston & Murphy Group.

Selling and administrative expense for the third quarter this year was 44.2 percent, up 60 basis points, compared to 43.6 percent of sales for the same period last year. The increase as a percentage of sales was driven by the negative comparable sales at Johnston & Murphy and increased selling salaries, partially offset by decreased store rent.

Genesco’s GAAP operating income for the third quarter was $25.9 million, or 4.8 percent of sales this year, compared with $26.4 million, or 4.9 percent of sales last year. Adjusted for the excluded items in both periods, operating income for the third quarter was $26.7 million this year compared with $26.3 million last year. Adjusted operating margin was 5.0 percent of sales in the third quarter of Fiscal 2020 and 4.9 percent last year.

Income tax expense for the quarter was $6.5 million, or 25.4 percent in Fiscal 2020 compared to $5.9 million, or 23.0 percent last year. Adjusted income tax expense, reflecting excluded items, was $6.9 million, or 26.2 percent in Fiscal 2020 compared to $6.4 million, or 25.1 percent last year. The higher adjusted tax amount for this year reflects the inability to recognize a tax benefit for certain foreign losses.

GAAP earnings from continuing operations were $19.0 million in the third quarter of Fiscal 2020, compared to $19.7 million in the third quarter last year. Adjusted for the excluded items in both periods, third quarter earnings from continuing operations were $19.4 million, or $1.33 per share, in Fiscal 2020, compared to $19.1 million, or $0.97 per share, last year and Wall Street’s consensus estimate of $1.08.

Cash, Borrowings and Inventory

Cash and cash equivalents at November 2, 2019, were $55.8 million, compared with $53.4 million at November 3, 2018. Total debt at the end of the third quarter of Fiscal 2020 was $79.5 million compared with $81.8 million at the end of last year’s third quarter, a decrease of 3 percent. Inventories increased 4 percent in the third quarter of Fiscal 2020 on a year-over-year basis.

Capital Expenditures and Store Activity

For the third quarter, capital expenditures were $8 million, which consisted of $5 million related to store remodels and new stores and $3 million related to direct-to-consumer, omnichannel, information technology, distribution center and other projects. Depreciation and amortization was $12 million. During the quarter, the company opened four new stores and closed six stores. The company ended the quarter with 1,492 stores compared with 1,537 stores at the end of the third quarter last year, or a decrease of 3 percent. Square footage was down 2 percent on a year-over-year basis.

Share Repurchases

For the third quarter of Fiscal 2020, the company repurchased 1,150,198 shares for approximately $41.3 million at an average price of $35.90 per share. Since late December 2018 through last Friday, the company has spent approximately $235 million repurchasing over 5.5 million shares across three authorizations totaling $325 million, including a new $100 million authorization announced in late September.

Fiscal 2020 Outlook

For Fiscal 2020, the company expects:

- Comparable sales to be up 2 percent to 3 percent, and

- Adjusted diluted earnings per share from continuing operations in the range of $4.10 to $4.40 with an expectation that earnings per share for the year will be near the mid-point of the range.

Previously, guidance called for earnings in the range of $3.80 to $4.20 with an expectation that earnings for the year will be near the mid-point of the range. Updated comparable sales guidance remains the same.