15 Nov 2018 Iconix Stung By Sears Bankruptcy

Iconix noted that its international business continues to outperform expectations and the company projected stable cash position and debt covenant compliance.

Bob Galvin, CEO commented, “Our results for the quarter were negatively impacted by the Sears bankruptcy filing which resulted in P&L charges, however, we continue to forecast debt covenant compliance. While the domestic business did not see the progress we had hoped for, our international business continued its profitable growth. We are critically evaluating our operational cost structure to ensure it is aligned with our current level of business and near term plans.”

Unless otherwise noted, the following represents financial results for continuing operations only.

Third Quarter 2018 Financial Results

For the third quarter of 2018, total revenue was $46.2 million, a 13 percent decline as compared to $53.2 million in the prior year quarter. For the nine months ended September 30, 2018, total revenue was $145.0 million, a 16 percent decline as compared to $173.5 million in the nine months ended September 30, 2017. Such decline was expected, principally as a result of the transition of Danskin, OP and Mossimo DTR’s in its Womens segment, as previously announced.

For the third quarter of 2018, total revenue was $46.2 million, a 13 percent decline as compared to $53.2 million in the prior year quarter. For the nine months ended September 30, 2018, total revenue was $145.0 million, a 16 percent decline as compared to $173.5 million in the nine months ended September 30, 2017. Such decline was expected, principally as a result of the transition of Danskin, OP and Mossimo DTR’s in its Womens segment, as previously announced.

Its Mens segment declined in the third quarter of 2018 primarily from the Starter and Buffalo brands. Its International segment provided organic growth primarily from the Umbro and Lee Cooper brands, specifically in the Europe, India and China territories. The Home segment declined 6 percent and 9 percent for the third quarter of 2018 and nine months ended September 30, 2018, respectively. As previously discussed, revenue in the Home segment year-over-year is partially down due to the terms of a renewal of the Waverly Inspirations contract with Walmart.

In the first quarter of 2018, the company adopted a new revenue recognition accounting standard (ASU No. 2014-09 Revenue from Contracts with Customers – Topic 606). Adoption of the standard increased Q3 2018 revenue by approximately $2.4 million and increased revenue for the nine months ended September 30, 2018 by approximately $0.6 million, and is expected to increase full-year 2018 revenue by approximately $2.5 to $3.0 million.

SG&A Expenses:

Total SG&A expenses in the third quarter of 2018 were $30.2 million, a 40 percent increase compared to $21.5 million in the third quarter of 2017. Included in these expenses was an $8.2 million bad debt expense as a result of the Sears bankruptcy filing. Excluding this bad debt expense, SG&A expenses were up 2 percent in the third quarter of 2018 as compared to the third quarter of 2017. In the third quarter of 2018, advertising expense increased 56 percent as compared to the third quarter of 2017 as result of increases in marketing spend for the Buffalo, Starter and Umbro brands. Stock based compensation was a benefit of $1.6 million in the third quarter of 2018 as compared to a benefit of $0.9 million in the third quarter of 2017.

Trademark and Goodwill Impairment:

In the third quarter of 2018, the company recorded a non-cash trademark impairment charge of $4.4 million in the Womens segment related to a write-down in the Joe Boxer trademark as compared to $521.7 million in the third quarter of 2017, comprised of $227.6 million in the Womens segment, $135.9 million in the Mens segment, $69.5 million in the Home segment and $88.7 million in the International segment, to reduce various trademarks in those segments to fair value. The company also recorded a non-cash goodwill impairment charge of $103.9 million in the third quarter of 2017 due to impairment of goodwill in the Womens segment, Mens segment and Home segment of $73.9 million, $1.5 million and $28.4 million, respectively, of which there was no comparable amount in the third quarter of 2018.

Operating Income

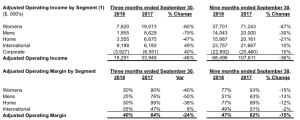

Operating income for the third quarter of 2018 was $12.1 million, as compared to operating loss of $595.9 million in the third quarter of 2017. Operating income in the third quarter of 2018 included trademark impairments of $4.4 million and special charges of $1.8 million. Operating loss in the third quarter of 2017 included trademark and goodwill impairments of $625.5 million, special charges of $2.4 million, a loss on termination of licenses of $2.8 million and gain on sale of trademarks of $0.9 million. When excluding these items, adjusted operating income was $18.3 million and $33.9 million in the third quarter of 2018 and the third quarter of 2017, respectively, and adjusted operating margin was 40 percent and 64 percent in the third quarter of 2018 and the third quarter of 2017, respectively. Operating loss in the third quarter of 2018 includes a $8.2 million bad debt expense as a result of the Sears bankruptcy filing.

Operating income for the third quarter of 2018 was $12.1 million, as compared to operating loss of $595.9 million in the third quarter of 2017. Operating income in the third quarter of 2018 included trademark impairments of $4.4 million and special charges of $1.8 million. Operating loss in the third quarter of 2017 included trademark and goodwill impairments of $625.5 million, special charges of $2.4 million, a loss on termination of licenses of $2.8 million and gain on sale of trademarks of $0.9 million. When excluding these items, adjusted operating income was $18.3 million and $33.9 million in the third quarter of 2018 and the third quarter of 2017, respectively, and adjusted operating margin was 40 percent and 64 percent in the third quarter of 2018 and the third quarter of 2017, respectively. Operating loss in the third quarter of 2018 includes a $8.2 million bad debt expense as a result of the Sears bankruptcy filing.

Operating loss for the nine months ended September 30, 2018 was $66.9 million, as compared to operating loss of $546.4 million in the nine months ended September 30, 2017. Operating loss in the nine months ended September 30, 2018included goodwill and trademark impairments of $115.5 million, special charges of $7.2 million, costs associated with recent debt financings of $8.3 million, a loss on termination of licenses of $5.7 million and gain on sale of trademarks of $1.3 million. Operating loss in the nine months ended September 30, 2017 included goodwill and trademark impairments of $625.5 million, special charges of $7.1 million, loss on termination of licenses of $26.0 million, a gain on sale of trademarks of $0.9 million, and a gain on deconsolidation of joint venture of $3.8 million. When excluding these items, adjusted operating income was $68.5 million and $107.6 million in the nine months ended September 30, 2018 and the nine months ended September 30, 2017, respectively, and adjusted operating margin was 47 percent and 62 percent, respectively.

Interest Expense, Other Income and Loss on extinguishment of debt:

Interest expense in the third quarter of 2018 was $14.9 million, as compared to interest expense of $16.9 million in the third quarter of 2017.

In the third quarter of 2018, the company recognized a $17.2 million gain resulting from the company’s accounting for the 5.75 percent Convertible Notes which requires recording the fair value of this debt at the end of each period with any change from the prior period accounted for as other income or loss in the current period’s income statement. Additionally, in the third quarter of 2018, the company acquired an additional 5 percent interest of its Iconix Australia joint venture and as a result, recognized a $8.4 million pre-tax non-cash gain on the remeasurement of the company’s initial investment. In the third quarter of 2017, the company recognized a $2.7 million gain related to a payment received from the sale of its minority interest in Complex Media in 2016 and recognized a $1.5 million expense related to the repurchase of a portion of the company’s 1.50 percent convertible notes, of which there was no comparable amount for the third quarter of 2018. The company has excluded these amounts from its non-

GAAP results.

Provision for Income Taxes:

The effective income tax rate for the third quarter of 2018 is approximately 4.5 percent which resulted in a $1.0 million income tax provision, as compared to an effective income tax rate of 4.9 percent in the prior year quarter which resulted in a $29.6 million in come tax benefit. Excluding any mark-to-market adjustments from the company’s 5.75 percent Convertible Notes, Iconic expects the full year 2018 tax rate to be approximately (4) percent and approximately 50 percent on a GAAP basis and non-GAAP basis, respectively.

GAAP Net Income and GAAP Diluted EPS:

GAAP net loss from continuing operations attributable to Iconix for the third quarter of 2018 reflects income of $20.2 million as compared to a loss of $550.6 million for the third quarter of 2017. GAAP diluted EPS from continuing operations for the third quarter of 2018 reflects a loss of $0.01 as compared to a loss of $9.64 for the third quarter of 2017.

GAAP net loss from continuing operations attributable to Iconix for the nine months ended September 30, 2018 reflects a loss of $31.4 million as compared to a loss of $559.7 million for the nine months ended September 30, 2017. GAAP diluted EPS from continuing operations for the nine months ended September 30, 2018 reflects a loss of $0.81 as compared to a loss of $9.83 for the nine months ended September 30, 2017.

Non-GAAP Net Income and Non-GAAP Diluted EPS:

Non-GAAP net income from continuing operations for the third quarter of 2018 was $1.2 million as compared to $13.9 million for the third quarter of 2017. Non-GAAP diluted EPS from continuing operations for the third quarter of 2018 was $0.02 as compared to $0.24 for the third quarter of 2017.

Non-GAAP net income from continuing operations for the nine months ended September 30, 2018 was $15.0 million as compared to $41.7 million for the nine months ended September 30, 2017. Non-GAAP diluted EPS from continuing operations for the nine months ended September 30, 2018 was $0.23 as compared to $0.73 for the nine months ended September 30, 2017.

2018 Guidance:

Primarily as a result of the Sears Holdings Corporation bankruptcy filing on October 15, 2018, the company is lowering full year guidance as follows:

- Full year revenue guidance lowered to $185 million – $195 million, down from $190 million to $220 million.

- GAAP net income guidance lowered to a loss of approximately $105 million – $115 million, from $94.4 million to $104.4 million.

- Full year non-GAAP net income guidance lowered to $5 million – $15 million, down from $20 million to $30 million

- Full year free cash flow guidance lowered to $40 million – $50 million, down from $50 million to $70 million

Iconix Brand Group Inc.’s brands include: Candie’s, Bongo, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Umbro, Lee Cooper, Ecko Unltd., Marc Ecko, Artful Dodger, and Hydraulic. In addition, Iconix owns interests in the Material Girl, Ed Hardy, Truth Or Dare, Modern Amusement, Buffalo and Pony. The company licenses its brands to a network of retailers and manufacturers.