17 Apr JD Sports Sees Sales Vault 49.2 Percent In 2018

JD Sports Fashion Plc, the U.K.-based athletic footwear giant that acquired Finish Line last year, reported profits before taxes rose 15.5 percent in its year ended February 1 on a 49.2 parent revenue gain.

Group Highlights

- Revenues rose 49.2 percent to £4,717.8 million from £3,161.4 million.

- Gross margins improved to 47.5 percent from 48.4 percent.

- Record result with EBITDA (before exceptional items) increased by a further 26.8 percent, to £488.4 million (2018: £385.2 million).

- Depreciation includes £29.4 million (2018: £nil) from the combined Finish Line and JD business in the United States in the 33-week period post acquisition.

- Headline profit before tax and exceptional items increased by 15.5 percent to £355.2 million (2018: £307.4 million).

- Profit before tax increased to £339.9 million (2018: £294.5 million).

- Encouraging total like for like sales growth in global Sports Fashion fascias of more than 6 percent achieved against a backdrop of widely reported retail challenges in the Group’s core UK market.

- Robust gross margin performance in like for like Sports Fashion businesses.

- International development of the JD fascia continues with a) Net increase of 39 stores (2018: 56 stores) for the JD fascia across Europe and b) A further 34 JD stores opened in the Asia Pacific region in the year (2018: nine stores)

- Acquisition of Finish Line in the United States significantly extends the Group’s global reach with the trial of the JD fascia delivering encouraging early results.

- Double-digit EBITDA maintained in the Outdoor fascias after a particularly weather-challenged trading period.

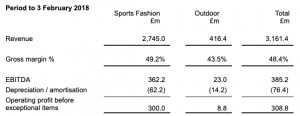

Revenue, gross margin and operating profit before exceptional items of the two business segments are tabulated below:

1 Depreciation/amortization includes non-trading charges for the amortization of various fascia names and brand names consequent to the accounting on acquisitions. These charges included Sports Fashion: £7.5 million (2018: £2.7 million) and Outdoor: £4.5 million (2018: £4.5 million).

Peter Cowgill, executive chairman, said: “I am very pleased to report that the Group continues to make excellent progress with Group EBITDA (before exceptional items) increasing by a further 27 percent, being more than £100 million, to £488.4 million (2018: £385.2 million). The headline profit before tax and exceptional items increased by a further 16 percent to £355.2 million (2018: £307.4 million) and, after delivering a headline profit of £100 million for the first time in the year to January 2015, the headline profit has now increased by more than £250 million over the subsequent four years, a compound rise in excess of 37 percent per annum. The Group profit before tax increased by 15 percent to £339.9 million (2018: £294.5 million).

“We firmly believe that the elevated and dynamic multibrand multichannel proposition of the core JD fascia, which enjoys the ongoing support of the key international brands, has the necessary agility to continue to exceed consumer expectations and prosper in an increasing number of international markets.

“We believe that our acquisition of the Finish Line business in the United States, the largest market for sport lifestyle footwear and apparel and the home to many of the global sportswear brands, will have positive consequences for our long-term brand engagement whilst significantly extending the Group’s global reach. We maintain our belief that Finish Line is capable of delivering improved levels of profitability.

“Given the significance of Easter trading to the overall result of the Group and the change in the timing relative to last year, any announcement of like for like sales performance in the year to date would lack precision. However, we are pleased with the continued underlying positive performance of the Group and are excited by the major developments ahead.”