16 May Macy’s Q1 Tops Wall Street’s Targets

Macy’s,Inc. reported earnings declined in the first quarter but easily topped Wall Street’s consensus estimates. Same-store sales inched up 0.6 percent. The department store giant confirmed its guidance for the year.

Highlights of the quarter include:

- Comparable sales growth of 0.6 percent on an owned basis; 0.7% on an owned plus licensed basis

- EPS and adjusted EPS of 44 cents per share. Wall Street’s consensus target had been 33 cents.

- 2019 strategic initiatives on track to deliver sales growth

- Company reaffirms annual 2019 sales and earnings guidance

“Macy’s, Inc. is off to a solid start this year, delivering our sixth consecutive quarter of comparable sales growth and making progress against the North Star Strategy. As an omnichannel retailer, we are focused on growing our customer base by providing a great experience across all channels and taking market share category by category. Our brick & mortar sales trend improved sequentially in the first quarter, supported by the Growth50 stores and Backstage. We had another quarter of double-digit growth in our digital business, and mobile continues to be our fastest-growing channel,” said Jeff Gennette, Macy’s, Inc. chairman & chief executive officer. “We are pleased with the progress we are making on our strategic initiatives as they continue to drive top-line growth, keeping us on track to reach our 2019 goals. We believe these initiatives, coupled with productivity improvements, position our company well for long-term profit growth.”

Asset Sale Gains

Asset sale gains for the first quarter of 2019 totaled $43 million pre-tax, or $31 million after-tax and $0.10 per diluted share attributable to Macy’s, Inc. shareholders. This compares to the first quarter of 2018, when asset sale gains totaled $24 million pre-tax, or $18 million after-tax and $0.06 per diluted share attributable to Macy’s, Inc. shareholders.

Extended and Amended Bank Credit Facility

On May 9, 2019, the company entered into a new $1.5 billion, five-year Credit Agreement that will mature on May 9, 2024. This agreement replaces a previous $1.5 billion facility, which was set to expire in May 2021. Macy’s, Inc. maintains a strong balance sheet, enabling the company to extend the maturity of the agreement on similar terms.

Looking Ahead

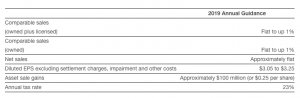

Macy’s, Inc. is reaffirming its previously provided annual guidance for 2019.