27 Apr Puma’s Q1 Earnings Leap

Puma reported operating earnings rose 70 percent on a 15 percent revenue gain on a currency-neutral basis.

Results were in line with an updated forecast given on April 12, when it raised its earnings guidance for the year.

Quarterly highlights

• Sales increase by 15 percent currency-adjusted to €1,005 million (+18 percent reported), with

all regions showing double-digit growth and Footwear being the main growth driver

• Gross profit margin improves slightly to 47.1 percent

• EBIT rises by 70 percent to €70 million mainly due to strong sales development

• Net earnings and earnings per share increase by 92 percent to €50 million and €3.32,

respectively

• Borussia Monchengladbach and Olympique de Marseille signed as of season 2018/19

Bjørn Gulden, Chief Executive Officer of PUMA SE:

“Thanks to good sell-through to the end consumer, both in our owned and operated retail

and with our key retail partners, our sales in Q1 developed above our expectation. For the

first time in the PUMA history, we achieved sales exceeding €1 billion in a quarter. Our EBIT

also developed very positively with a growth of 70 percent to €70 million. This stronger than

expected start of the year further shows that PUMA is on the right path. Therefore we have

raised our outlook for the full year to low double digit growth in revenue and the full-year

EBIT to be between €185 million and €200 million.”

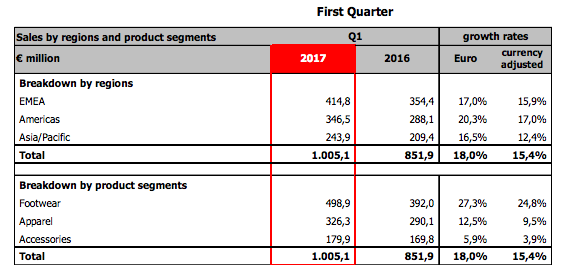

Q1 Growth Rates

PUMA’s sales growth continued in the first quarter of 2017. Sales increased by 15.4 percent

currency-adjusted to €1,005.1 million (+18.0 percent reported), compared to €851.9 million in

the previous year. All regions supported the sales growth showing a double-digit increase.

Footwear remained the main growth driver.

The gross profit margin improved slightly by 30 basis points from 46.8 percent in the first

quarter 2016 to 47.1 percent. The increase was due to selective price adjustments and further

improvements in sourcing.

Operating expenses rose by 12.5 percent and amounted to €406.8 million in the first quarter

2017. That increase was driven by intensified marketing activities, investments in own retail

stores and higher sales-related variable costs. Other operating functions kept the costs

stable.

The operating result (EBIT) increased by 70.1 percent to €70.2 million, as sales grew stronger

than operating expenses, supported by a slightly higher gross profit margin.

Net earnings improved by 92.2 percent to €49.6 million (prior year: €25.8 million) and

earnings per share were up correspondingly at €3.32 compared to €1.73 in the first

quarter 2016.

Working Capital:

PUMA’s working capital rose by only 4.3 percent from €768.4 million to €801.8 million, despite

the significant increase of sales and business volume.

Outlook 2017:

In light of the strong first-quarter increase in sales and profitability as well as the positive

business outlook for the current year 2017, PUMA raises the full-year guidance for its

consolidated sales and operating result (EBIT).

The management now expects that sales will increase currency-adjusted at a low doubledigit

percentage rate (previous guidance: currency-adjusted increase at a high single-digit

percentage rate). The guidance for the gross profit margin remains unchanged

(improvement to approximately 46.0 percent; previous year: 45.7 percent). Operating expenses for the

full-year 2017 are now expected to increase at a high single-digit percentage rate (previous

guidance: mid to high single-digit percentage rate).

As a consequence the operating result (EBIT) is now anticipated to come in between €185

million and €200 million (previous guidance: between €170 million and €190 million). In

line with the previous guidance, the management still expects that net earnings will improve

significantly in 2017.