Tariff Reduction Initiatives

- November 24, 2025 Letter to Trump Administration Tariff Reduction

- July 9, 2025 FDRA Letter to Trump Administration on Tariff Stacking

- April 29, 2025 Letter to President Trump on Sneaker Production and Tariffs

- April 29, 2025 FDRA Letter to President Trump urging Swift Tariff Relief

- March 11, 2025 Comments-USTR on Non-Reciprocal Trade Arrangements

- June 28, 2024 Comments-USTR on Modifications to Section 301 Action

- May 10, 2024 Company Letter to President Biden on tariff relief

- April 11, 2024 Letter to President Biden on tariff relief and inflation

- November 14, 2023 Letter to President Biden on targeted approach to tariffs

- August 7, 2023 Comments-USTR on worker-centered trade policy

- January 17, 2023 Comments-USTR on 4-year tariff review

- September 14, 2023 Amicus Brief on 301 Tariff Lawsuit

- August 24, 2022 Comments on 301 Tariff Economic Impact

- May 12, 2022 Letter to President Biden on footwear tariff relief and inflation

- March 1, 2022 Letter to President Biden on footwear tariff relief and inflation

- February 17, 2022 Letter to Jared Bernstein on tariff relief and inflation

- November 17, 2021 Letter to President Biden on footwear tariff relief

- October 19, 2021 Letter to President Biden on children’s footwear tariff relief

Americans paid ~$9.3 billion more for shoes at retail than needed in 2024

FDRA has been advocating on behalf of the footwear industry for over 80 years. Headquartered between the White House and the U.S. Capitol in Washington, DC, FDRA is THE voice of the footwear industry and constantly pushes for both the full elimination of ALL footwear duties and for the free flow of footwear worldwide.

With 99% of all footwear sold in the U.S. imported, footwear tariffs that were put in place in the 1930s do not protect American jobs as intended, but actually hinder the footwear industry from expanding jobs here in the US. Rather than pay $3.339 billion in footwear duties in 2024, companies could have used those funds to innovate, reinvest, and hire new workers in the fields of design, marketing, retail, and logistics including jobs at ports, warehouses, and in trucking. Doing away with these duties would save American consumers billions annually on their shoes at retail!

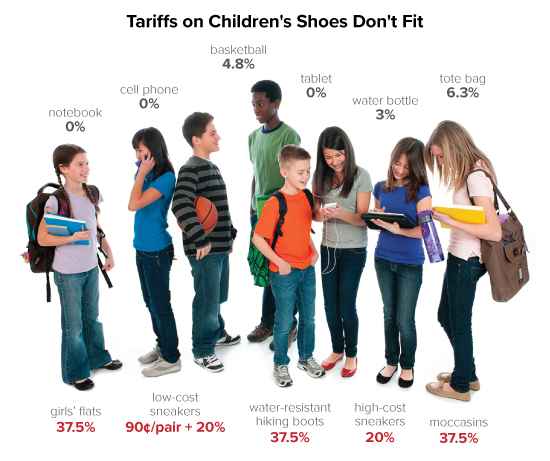

Footwear tariffs are also some of the highest on any imported consumer good, averaging 12.3% but reaching upwards of 48% and 67.5% on certain footwear types. Meanwhile, certain imports like iPhones have no duty rate. Tariffs directly increase the cost of footwear at retail, hitting hard working families the hardest as lower cost basic shoes face significantly higher tariffs than men’s leather dress shoes (8.5%).

Footwear Companies paid $3.339 billion in duties in 2024, hurting consumers and job creation. More on Shoe Tariffs.

FDRA’s Legislative Initiatives

To accomplish its mission of eliminating outdated tariffs, the FDRA team meets constantly with U.S. and International officials, Members of Congress and Senators to tell the industry’s story and propel trade policy on footwear forward into the 21st Century. FDRA staff have over 20 years of combined work experience serving in Congress and use their expertise to push for a number of legislative initiatives to end tariffs on footwear—initiatives focused on lowering consumer costs and creating American jobs. FDRA members seeking current information on trade agreements and initiatives can find that in our Intel Center.

ALERT: Kids shoe prices hit record highs, harming families (2022)

- Footwear prices rose 7.0% y/y, second only to May’s fastest y/y increase in 33 years.

- Men’s (+5.3%), women’s (+6.8%), & children’s (+10.3%) all extended sharp gains in February.

- Prices for kids’ shoes jumped at a double-digit rate in February from a year ago to an all-time high.

Miscellaneous Tariff Bill (MTB)

FDRA has worked hard to file a number of Miscellaneous Tariff Bill (MTB) requests for temporary tariff relief for footwear, and more than 200 footwear MTB requests were filed during the 2019-2020 petition cycle. MTBs provide temporary tariff relief for products that are not available in the U.S. like certain chemicals, machinery, equipment, footwear, and apparel. The American Manufacturing Competitiveness Act, the law that establishes the new MTB process, states that imposing duties where there is no domestic availability or insufficient domestic availability negatively impacts both U.S. manufacturers and consumers. Footwear duties are some of the highest in the U.S. Tariff Code and are even higher on lower priced footwear. Temporarily reducing these duties through MTBs greatly benefits U.S. consumers with lower prices and increases the competitiveness of American footwear businesses. The International Trade Commission (ITC) released its final report to Congress in August, and FDRA will work to ensure that much-needed MTB legislation is enacted as soon as possible.

Generalized System of Preferences (GSP)

FDRA has long advocated for expanding the current Generalized System of Preferences (GSP) to include footwear, so that companies that produce shoes in Cambodia, Indonesia and a number of other developing nations can utilize this important trade preference program. Created in the 1970s, GSP provides duty-free access for certain goods produced in more than 120 countries, with a strong focus on least developed countries. It benefits American families and individuals with greater choice and value on many basic consumer goods and remains key to helping lift individuals in developing nations out of poverty. Although the program does not include the two largest footwear-producing countries, China and Vietnam, expanding GSP to include footwear would increase opportunities for companies looking to diversify sourcing and generate significant duty savings for the industry. FDRA is currently working on an initiative that will reform and expand the program to cover footwear.

United States-Mexico-Canada Agreement (USMCA)

The USMCA was ratified by the Senate in January 2020. FDRA made the following statement, “The day after the United States and China signed a Phase One trade deal, the Senate ratified the United States-Mexico-Canada Agreement (USMCA). Unlike the China deal, however, the USMCA expands free trade and continues much-needed tariff relief for U.S. companies. The U.S. footwear industry applauds the passage of the USMCA and calls on the Trump Administration to increase its efforts to open markets around the world and lower duties for American shoe companies and our customers.” The USMCA did not impact Chapter 64, the footwear chapter. While NAFTA has played an important role over the years for many U.S. companies including manufacturers, the limitations it placed on footwear rules of origin have greatly inhibited the ability of the footwear sector to develop in North America. In fact, in 2019, NAFTA was utilized for only 0.2 percent of all pairs of shoes imported into the U.S. market. While it does not change these restrictive rules of origin, the USMCA is still important for the industry because it establishes the rules for 21st Century trade, environment, intellectual property, and labor standards and will serve as a framework for future U.S. free trade agreements.

Footwear Tariff Simplification & Classification Clarity

With so many different ways to classify footwear as it’s imported into the U.S. (436 ways in case you were curious), FDRA is working with its membership to develop a more simplified approach to this arcane system. The U.S. tariff code for footwear is a complex and complicated construct of codes and descriptions based on materials used for production, cost of imported goods, understood potential consumer use, and gender…sometimes. Over time, the classification system has created a subjective standard applied by U.S. Customs & Border Patrol (CBP). FDRA wants to change that—both through simplification and convincing customs to create more objective standards that can be used to classify shoes that are actually used for athletic purposes and not the pair of athleisure kicks you and your friends sport to Sunday brunch.